How to Enter a Bounced Check in Quickbooks

The next time you discover a bounced check from a client or customer log into your Quickbooks account and click on the Receive Payments icon on the home screen. Here is an example of how to record the NSF fee for the example with Pauls Plumbing.

Handle Non Sufficient Funds Nsf Or Bounced Check From Customers

If you insert a date you will find the bounced check into the payment date field and select from different categories.

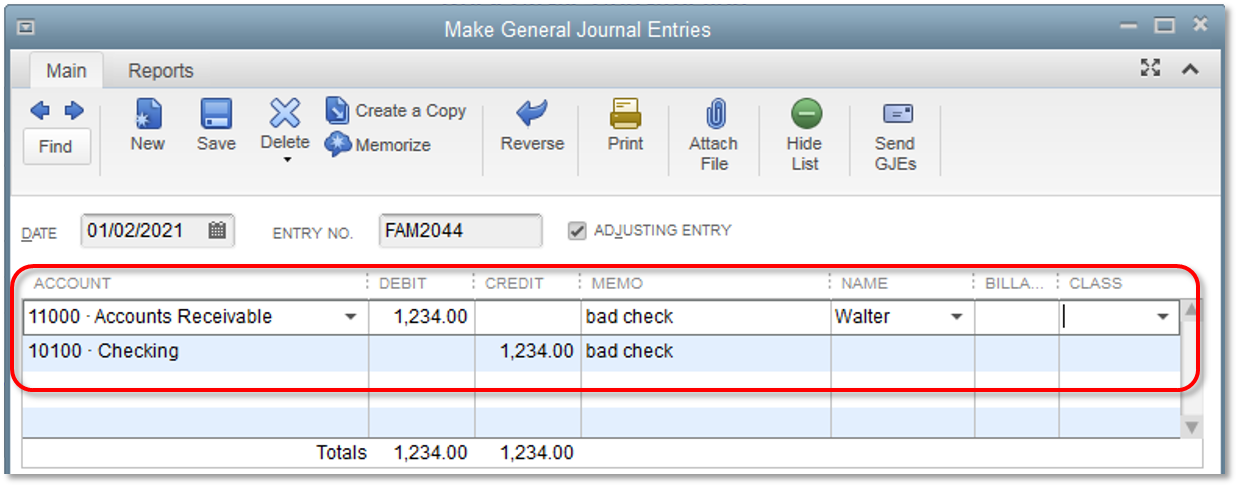

. Recording an NSF fee in QuickBooks Online. Do not enter the NSF fee. Go to Lists Item List and create a new Other Charge item called Bounced Check mapped to the clearing account you created above.

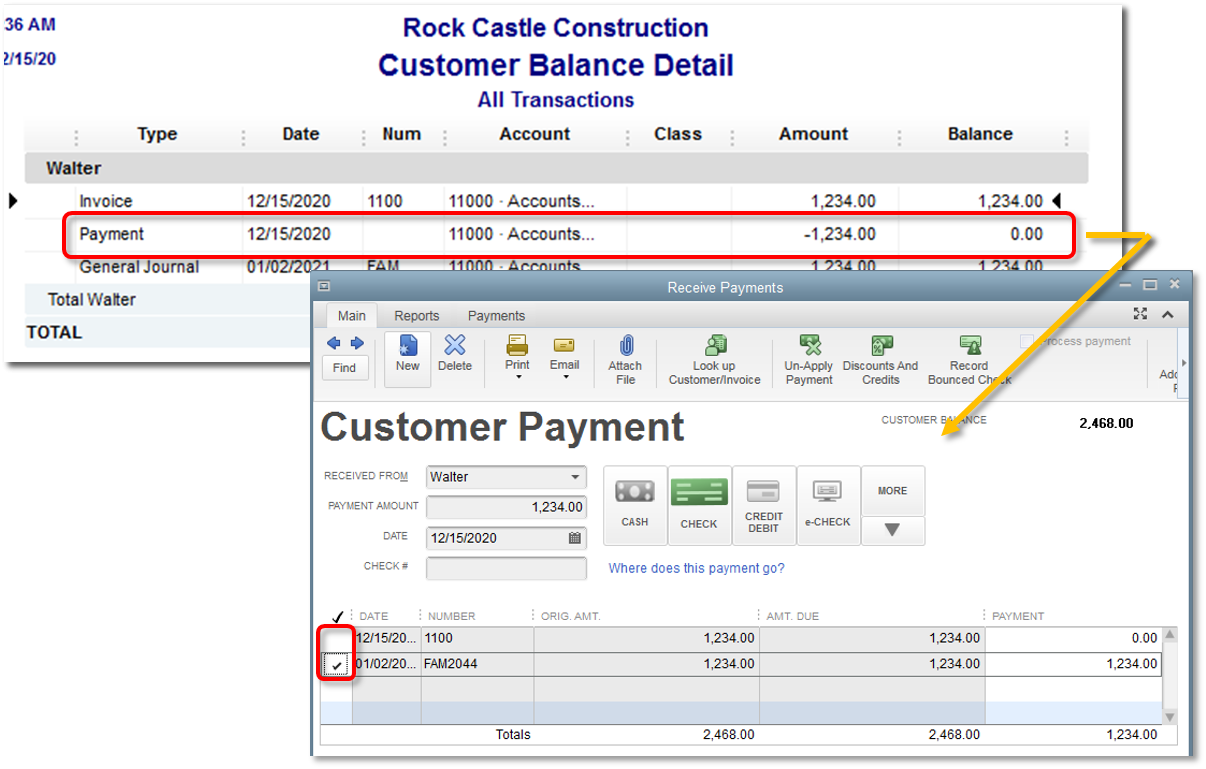

To use this feature log in to your Quickbooks account and click Customers Customer Center Transactions Received Payments. By doing this you will put the money back into the clients accounts receivable. Click on the sign that is New button.

Select the Lists menu and choose Item List Select New in the Item drop-down list. Quickbooks Desktop actually has a bounced check feature thats designed specifically for recording bounced check payments. Recording bounced checks from sales receipts sales into QuickBooks desktop requires the original method of recording bounced checks before the bounced check.

Then make a new invoice to the customer so that the customer receives a new invoice for the amount of the returned check and the fee that your company charges. Enter a memo returned check in the memo column. After Selecting the name of the customer select Account Money as it was in the check.

Thankfully Quickbooks offers a simple solution to dealing with bounced checks and other forms of non-sufficient funds. Go to Lists Chart of Accounts and create a new bank account called Clearing account. Create a Journal Entry In QuickBooks navigation Panel.

When you find the payment double click to open it. 6For the Account choose Accounts Receivable. This video will teach you how to enter NSF - Bounced checks from your Customers.

Memo enter additional information and the notes about the bounced check. This item should be mapped to your checking account the account which you deposit checks to. Click on the CompanyMake General Journal Entries selection to get to the related area in QuickBooks.

If youve done this before skip to Step 2. Under the customer select New transaction and Invoice. Enter the amount of the returned check.

Open a new expense screen by clicking on New at the top of the left menu bar and then selecting Expense as done in step 1. You can also click on the Banking menu on top of the screen and then select Use Register from the drop-down list. QuickBooks displays a window to capture the NSF information fee bank date and fee you want to charge to your client along with account and.

Amount enter the amount of the returned check. Click the Split button. Create items that track bad checks and their fees if you have not already done so.

Clear the original. After that click on the Journal Entry. Select the bank that charged you an NSF fee as the payee.

Here are the instructions for how to handle a bounced check in QuickBooks without affecting your sales reports. Click the button to start the process. Create items for tracking bounced checks and their associated charges.

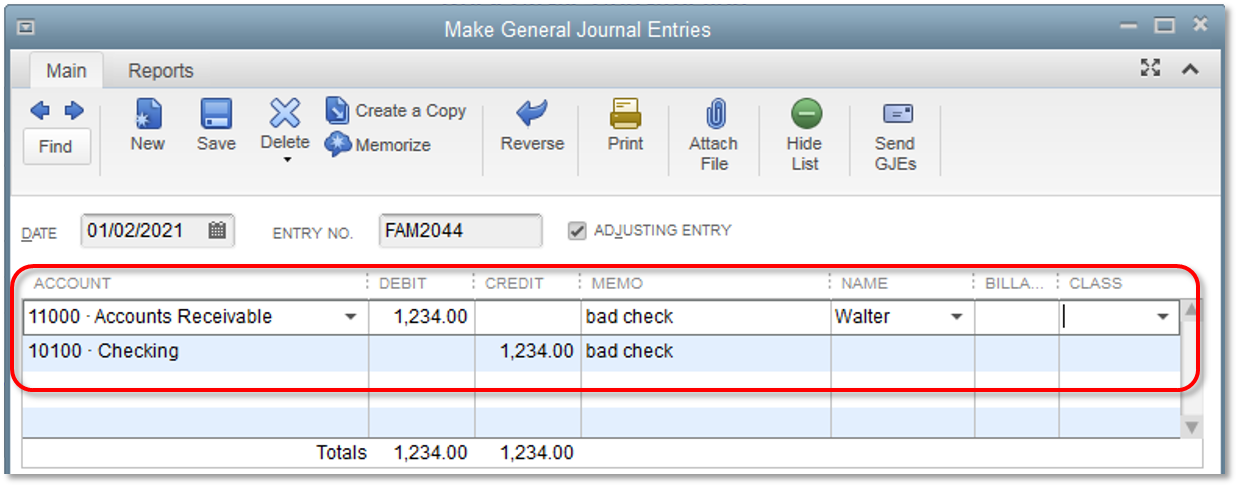

Mention the date of bounced check by bank in the journal date. Record the bounced check in a journal entry. Account select the appropriate AR.

Go to the Lists menu and click Item List. Description enter the information about the bounced check. Display that received payment.

Click Items at the bottom of the list and then click New. Input the bank charge which is a credit to the account and a debit to expenses. Go to Lists Item List and look for Other Charge Items called Bounced Check and Bounced Check Fee.

There are three different ways in which you can handle a customers bounced check. Under productservice type in Bounced Check. This is a one-time setup task.

But not affecting income in a prior period. Learn How to Record a Bounced Check From a Customer in QuickBooks with Rhonda Rosand CPA and QuickBooks ProAdvisor from New Business Directions LLC. If they are already on your Item List you can skip step 1.

Record a returned or bounced customer check using a journal entry. Accounting Basics Bookkeeping Bookkeeping Tips How-Tos in QuickBooks QuickBooks QuickBooks Help Small Business. QuickBooks new Record Bounced Check feature makes this super simple.

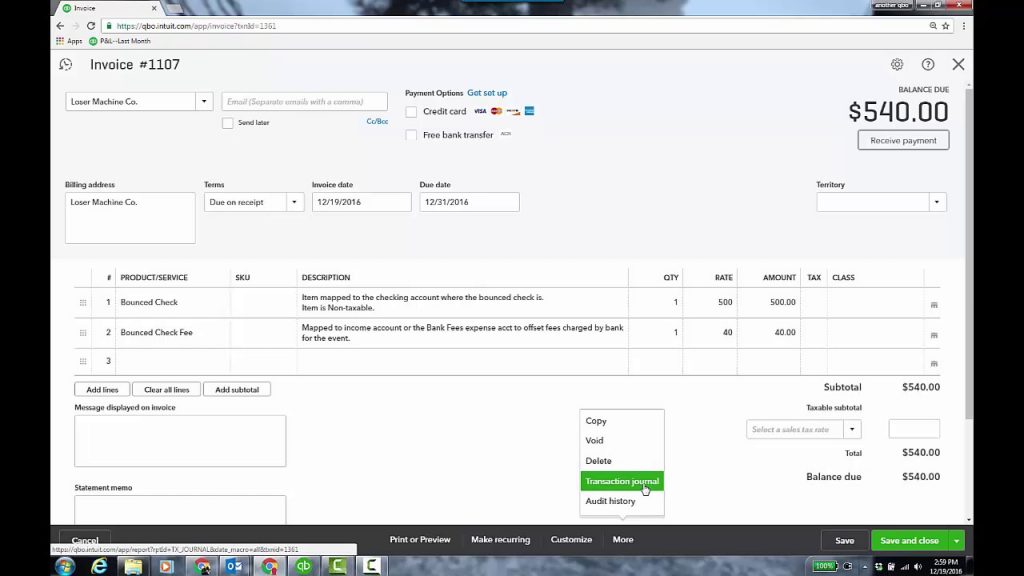

Slide 1 When the Received Payment window opens you will notice the new Record Bounced Check button. Instructions To record bounced checks in QuickBooks Desktop Pro select Customers Receive Payments from the Menu Bar. From your QuickBooks Desktop home page click on the Banking menu and then select Check Register.

You only need to set up the item once. Handling bounced checks in QuickBooks can be confusing and many people are looking for a quick and efficient way to handle bounced checks so the bank reconciliation can show both the money in and the money out. Navigate to Your Check Register in.

Bounced Checks in QuickBooks Desktop Pro. Then find or navigate to the specific customer payment you received that contains the bounced check. Choose the client in the Customer column that it was returned against.

Create a new item if needed. Select Other Charge in the Type drop-down list and then enter a name for the item such as Bad Check Change the Tax Code to Non and leave Amount or at zero. Update the date to the date of the original deposit.

Enter the amount which was in Bounced Checks from the Amount category. Payee select the customer whose check bounced. Check no enter the non-sufficient funds fee.

Now scroll through the list of payments youve received until you find the. Create an item for bounced check fees from your bank. Then select the other section.

Solved Reconciling Bounced Check

How Do I Record Nsf Donor Check

How To Record Returned Or Bounced Check In Quickbooks

Handle Non Sufficient Funds Nsf Or Bounced Check From Customers

No comments for "How to Enter a Bounced Check in Quickbooks"

Post a Comment